The impact of interest rates on small businesses in the United States

The Role of Interest Rates in Small Business Operations

Interest rates are fundamental to the financial landscape, influencing small businesses in profound ways across the United States. The fluctuations in interest rates can have far-reaching implications, affecting everything from operational financing to consumer behavior. Therefore, it is crucial for small business owners and stakeholders to grasp the various impacts of these rate changes in order to make sound financial decisions.

Borrowing Costs: One of the most immediate effects of rising interest rates is an increase in borrowing costs. For small businesses, securing financing through loans is often essential for day-to-day operations, expansion projects, or unexpected expenses. For instance, if a small retail business seeks a bank loan of $50,000 to expand its inventory, a nominal increase in interest rates—from, say, 4% to 6%—can lead to thousands of dollars in additional repayments over the loan’s lifespan. Such increased costs may force small businesses to rethink their financial strategies, limiting access to necessary capital and impacting overall growth.

Consumer Spending: Interest rates also indirectly impact the purchasing power of consumers. When rates rise, credit card interest rates often follow suit, making consumer borrowing more expensive. As consumers face higher payment obligations, they may reduce discretionary spending on non-essential goods and services. For example, a small restaurant may experience a decline in foot traffic as families opt to cut back on dining out. This reduction in consumer expenditure can create a ripple effect, leading to lower sales and ultimately affecting the business’s bottom line.

Investment Decisions: Increased borrowing costs may also lead small business owners to delay or forgo investment in growth opportunities. For example, a small manufacturing firm considering an upgrade to more efficient machinery may decide against it if financing the project becomes prohibitively expensive due to higher interest rates. Such decisions not only stifle business innovation but also potentially hinder long-term profitability. The reluctance to invest can have a compound effect, possibly leading to reduced competitiveness in a rapidly evolving market.

Understanding the interconnectedness of these factors is critical for small business owners as they navigate the complexities of an ever-changing economic environment. Armed with insights into how interest rate trends impact their operations, small business stakeholders can better prepare for financial fluctuations, adapt their strategies for resilience, and maintain a focus on sustainable growth. Continuous monitoring of interest rates, along with comprehensive financial planning, will not only help mitigate risks but also facilitate opportunities within this dynamic landscape.

DIVE DEEPER: Click here to discover the latest trends and opportunities

Understanding the Economic Environment

The economic environment significantly shapes the operations of small businesses, with interest rates acting as a critical component influencing multiple facets of their functioning. Small businesses are particularly susceptible to fluctuations in interest rates due to their reliance on loans for both operational and developmental needs. A detailed examination of how interest rates impact small businesses provides insight into the broader implications for the economy and highlights the need for strategic financial planning.

Cash Flow Management: Fluctuating interest rates can profoundly affect the cash flow of small businesses. Higher interest payments on existing debts reduce the amount of cash available for other operational expenses, such as payroll, rent, and inventory costs. As a result, small business owners might find themselves faced with difficult budgetary decisions. For instance, if a small business has a variable-rate loan, an increase in interest rates may lead to higher monthly payments, potentially straining their financial resources. This can create challenges in maintaining essential operations and may necessitate cost-cutting measures that could undermine growth prospects.

Access to Capital: The relationship between interest rates and access to capital is one of the most pressing issues for small businesses. When interest rates rise, lenders often tighten their lending standards, making it more difficult for small enterprises to qualify for financing. Small business owners must be prepared for potential barriers to access capital, such as:

- Stringent credit requirements: Lenders may require higher credit scores, increased collateral, or more detailed financial documentation, limiting opportunities for those without robust financial histories.

- Extended approval times: Rising interest rates can lead to more cautious lending behaviors, resulting in longer periods for loan approval, which may delay urgent financing needs.

- Reduced credit availability: Some lenders might cease offering certain types of loans altogether, particularly those with higher risk profiles, thus restricting the options available to small business owners.

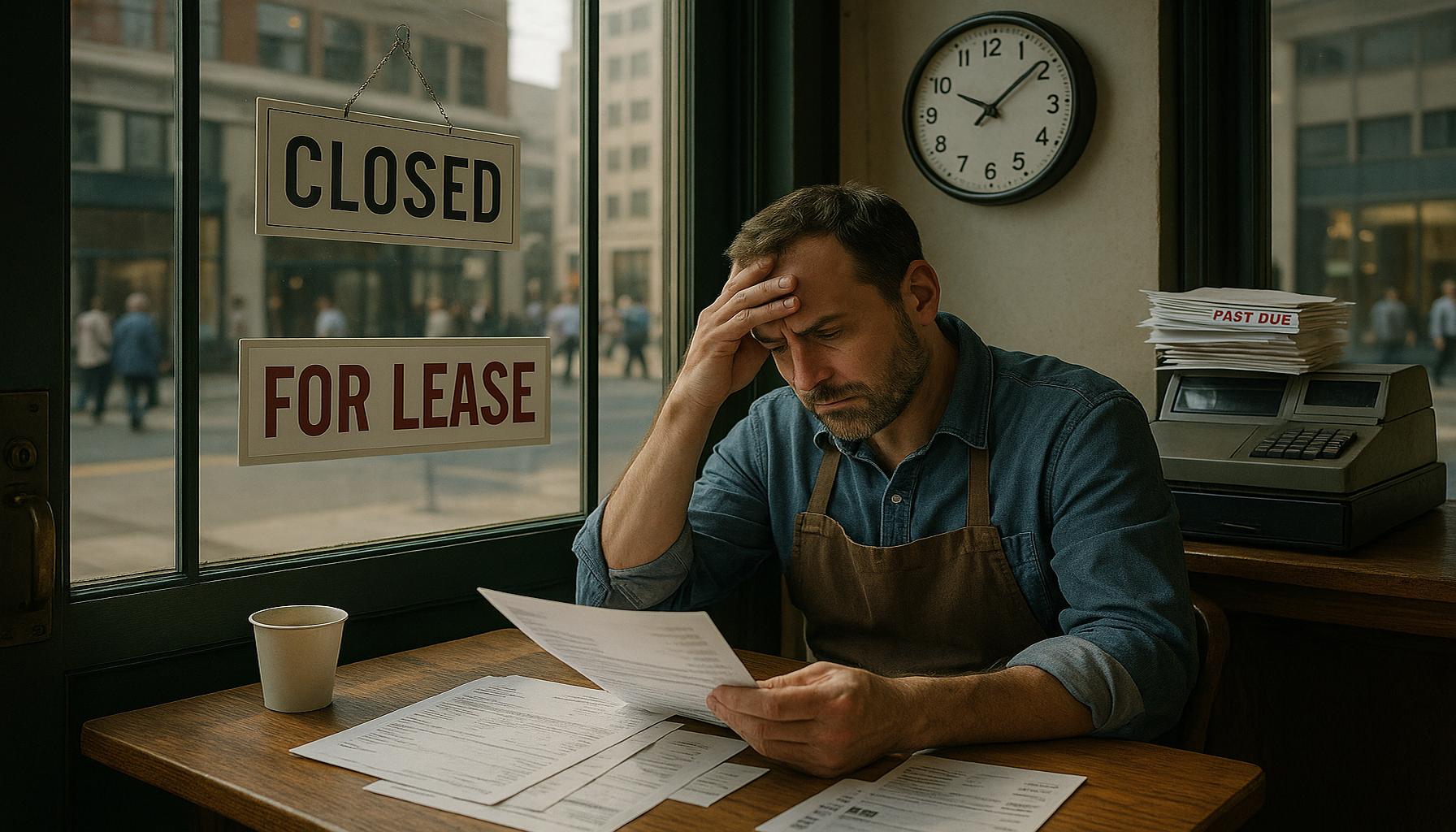

Real Estate and Lease Impact: In addition to direct borrowing costs, interest rates have broader implications for real estate purchases and leases. Small businesses looking to acquire commercial property may face difficulties as higher rates increase mortgages or financing costs. Less favorable borrowing conditions can deter potential business expansions, which are often contingent upon securing suitable locations. Moreover, existing tenants may see increased costs as landlords pass on higher financing expenses through elevated lease rates.

In essence, small businesses must adapt not only to the immediate impacts of rising interest rates but also to the evolving economic landscape influenced by these rates. To effectively manage their operations amidst interest rate changes, small business owners should actively consider diversifying their funding sources, evaluating their debt strategies, and engaging in thorough financial forecasting. By being well-informed and proactive, small enterprises can position themselves to navigate challenges and seize opportunities that may arise in a shifting economic climate.

DISCOVER MORE: Click here to boost your productivity

Strategic Financial Planning and Risk Management

In light of the challenges presented by changing interest rates, small businesses must implement effective strategic financial planning and risk management practices to mitigate potential negative impacts. This involves not just understanding current financial conditions but also preparing for future fluctuations that could affect their funding and operations.

Interest Rate Hedging: One approach small businesses can utilize is interest rate hedging, which involves financial instruments such as interest rate swaps or options to guard against fluctuations in borrowing costs. By entering into hedging contracts, small business owners can stabilize interest expenses, creating predictability in cash flow and allowing for enhanced budgeting. For example, if a small business anticipates higher interest rates in the future, locking in a fixed rate now could prevent the financial strain of increased borrowing costs down the line.

Enhancing Financial Literacy: Building financial literacy among small business owners is essential. Understanding how interest rates work and their potential implications on cash flow, financing costs, and overall business health empowers entrepreneurs to make informed decisions. Educational resources, workshops, and mentoring programs can significantly enhance the financial acumen of small business owners, equipping them with the tools to navigate complex financial landscapes.

Utilizing Community Resources: Small businesses often benefit from local and community resources designed to support entrepreneurs. Organizations, such as the Small Business Administration (SBA), provide invaluable assistance through loans, grants, and advisory services tailored for small businesses. By tapping into these resources, business owners can gain access to favorable financing terms and detailed guidance on adapting their strategies in response to shifting interest rate environments.

Emphasizing Diversified Revenue Streams: Diversification can also be a strategic defense against interest rate volatility. By broadening their service or product offerings, small businesses can create additional revenue streams that help absorb shocks from increased interest expenses. For example, a retail company may consider incorporating online sales or service-based offerings to offset potential declines in traditional revenue caused by higher operational costs due to elevated interest rates.

Building Stronger Credit Profiles: Regularly reviewing and improving their credit profiles can position small businesses favorably during periods of high-interest rates. Lenders typically evaluate a business’s creditworthiness when determining loan terms. Small business owners should work to maintain low debt-to-equity ratios, timely payment histories, and comprehensive financial documentation. Additionally, strengthening relationships with banking institutions can foster trust and increase access to credit lines, especially when market conditions become tight.

Scenario Planning: Conducting scenario planning exercises can also enhance the resilience of small businesses against interest rate fluctuations. Business owners should consider various economic scenarios, projecting the impacts of rising or falling interest rates on cash flow, revenue, and overall financial health. By developing contingency plans that outline steps to take in different scenarios, small businesses can better prepare themselves for unexpected developments in the economic environment.

In conclusion, small businesses in the United States face unique challenges posed by interest rate fluctuations, which manifest in cash flow management, access to capital, and overall financial stability. However, with proactive strategic planning and risk management, entrepreneurs can better navigate these challenges, ensuring their business can thrive even in uncertain economic conditions.

DISCOVER MORE: Click here for essential investment tips!

Conclusion

As we have seen, the impact of interest rates on small businesses in the United States is profound and multifaceted. Fluctuations in interest rates influence borrowing costs, cash flow, and overall financial health, making it essential for entrepreneurs to stay vigilant and informed. The increasing cost of financing can hinder the growth potential of small businesses, while rising interest rates may squeeze profit margins and disrupt planned investments.

However, small business owners are not without resources to combat these challenges. By adopting proactive financial strategies, such as interest rate hedging, enhancing financial literacy, and leveraging community resources, entrepreneurs can equip themselves to navigate changing economic landscapes effectively. Furthermore, focusing on diversified revenue streams and maintaining a strong credit profile positions businesses favorably within the lending environment, even amidst rising interest trends.

In addition, implementing robust scenario planning will enable business owners to be better prepared for unforeseen fluctuations in interest rates and their potential impact on operations. By embracing these practices, small enterprises can not only endure but also thrive, demonstrating resilience against economic challenges.

Ultimately, the relationship between interest rates and small businesses is an ongoing conversation, shaped by economic fluctuations and policy decisions. As entrepreneurs continue to adapt to this dynamic environment, understanding how to respond strategically will remain a critical component of fostering long-term business success in the United States.

Linda Carter is a writer and financial consultant specializing in economics, personal finance, and investment strategies. With years of experience helping individuals and businesses make complex financial decisions, Linda provides practical analyses and guidance on the Meaning of Dreaming platform. Her goal is to empower readers with the knowledge needed to achieve financial success.